I was listening to Dan Primack’s podcast on Pro Rata and he was interviewing Senator Klobucher who is now publicly and vocally speaking out against Uber purchasing Grubhub and has tried to mobilize against this.

Her argument is that if Uber buys Grubhub (which itself once merged with Seamless) it would mean that Uber Eats / Grubhub would control half the market and that with DoorDash the two together would control 90% of the market. I think that’s a largely flawed fight to be picking and of all the uses of Senator Klobuchar’s I could think of some much more productive fights to be having.

For starters Uber itself has had to lay off 27% of its workforce due to the pandemic and has been severely impacted financially from the crisis with no immediate respite in sight. Its core business was already struggling to become profitable, so having tertiary businesses like food delivery that can deliver needed profits would be welcome to their financial stability. And the market would still have DoorDash and PostMates duking it out as well as the potential that players like Instacart broaden their business one day or Amazon gets into food delivery.

Even more likely is eventual technology disruption where drones deliver foods and make it hard for existing car delivery services to compete. It won’t happen right away but I’ve seen some innovative companies doing exactly this in places like Australia where they are taking a more liberal approach to allowing drone deliveries. Therein lies the advantages of free markets and competition and if we really believed it were that easy to buy off your largest competitor and be a monopolist we’d all be surfing on AOL TimeWarner portals.

But the broader issue that hasn’t garnered much press attention is how the restaurant industry itself is being transformed and what tools a modern restaurant will need to compete. What is the Shopify of the restaurant industry? I have some compelling data that suggests it may just become ChowNow.

We know that the restaurant business already operates on thin margins and many struggle to survive. So when delivery services came along many were willing to pay the fee to try and increase business. It was only about 10–15% of their actual total revenue per month so for many it wasn’t a battle worth fighting — they just put up with the food delivery company fees. Customers were happy and restaurants focused on their in-store business.

The problem for the restaurants is that the more successful the “aggregators” of customer demand become over time, the less power the restaurants themselves have individually. This will largely be true whether you have 2 strong competitors or 5 because unless a delivery company can make a profit it won’t continue to stay in business.

The delivery companies own the customer relationship and can drive traffic to the most profitable restaurants for them. Obviously if you have a great restaurant brand with differentiated food people search for you by name but for many people looking for pizza, sushi, Mexican food, Thai food, whatever, you might go with the choice put in front of you if it’s being recommended or delivered more quickly. The delivery companies also own many of the assets like the photography so they can make certain options look much more attractive.

So just like when Groupon came out many small merchants welcomed the uptick in traffic, without owning the customer you lose the most valuable asset — the ability to re-market to your customer base and encourage them to become more loyal and more frequent customers. You lose the ability to up-sell and cross-sell products. And just like with Groupon the small businesses ended up having many unprofitable customers.

At Upfront we always took the approach that we wanted to back startups that enabled merchants to own the customer relationship and to increase profits by becoming excellent at marketing and serving ones most loyal customers.

So several years ago we backed a company called ChowNow that enables restaurants to offer self-service ordering for pick-up or delivery and the restaurant owns all of the customer information and relationship — ChowNow is simply a SaaS enablement product.

The company has done well over the past several year but never really captured the same press mindshare as the food delivery companies because when a company shows up at your house you get to know that brand rather than the tech that enables restaurants.

Covid-19 has changed all of that. Whereas pickup & delivery may have been 10–15% of a restaurant’s business before it’s currently 100% and when it’s your entire business the thought of paying huge commissions to a third-party delivery service becomes much less attractive. So while many restaurants knew they eventually needed to invest in better order management software, many had been putting it off.

But just as many product or apparel companies were happy selling at Amazon, Walmart or Nordstrom in the past and have lately realized the importance of Shopify and serving customers directly — so, too, are restaurants. Enter ChowNow.

What data do I have to make the case?

- ChowNow now has 17,000 restaurants using its SaaS platform for take-out and delivery and is adding more than 2,000 / month right now (and trending up)

- 10 million diners now use the ChowNow ordering platform vs. 24 million for GrubHub, so like Shopify while they built the customer base slowly and with capital efficiency they are now rivaling the bigger players in footprint

- Last year they were serving 50,000 customers / day through their platform and did approximately $500 million in GMV (the value of the orders placed), this year they are on track to do $3 billion (with a B) and expect to end the year at a revenue run rate that may top $100 million (yes, I asked for permission to publish these numbers).

If you want to see a short spot that outlines the importance of the restaurant industry arming itself with better software tools to serve and market to their customers you may enjoy this 60-second video that makes it clear why it matters. It speaks volumes to why we all love our local restauranteurs and want to see them survive …

https://medium.com/media/dab8c9b98b12a45a4b06435888cc7fc0/href

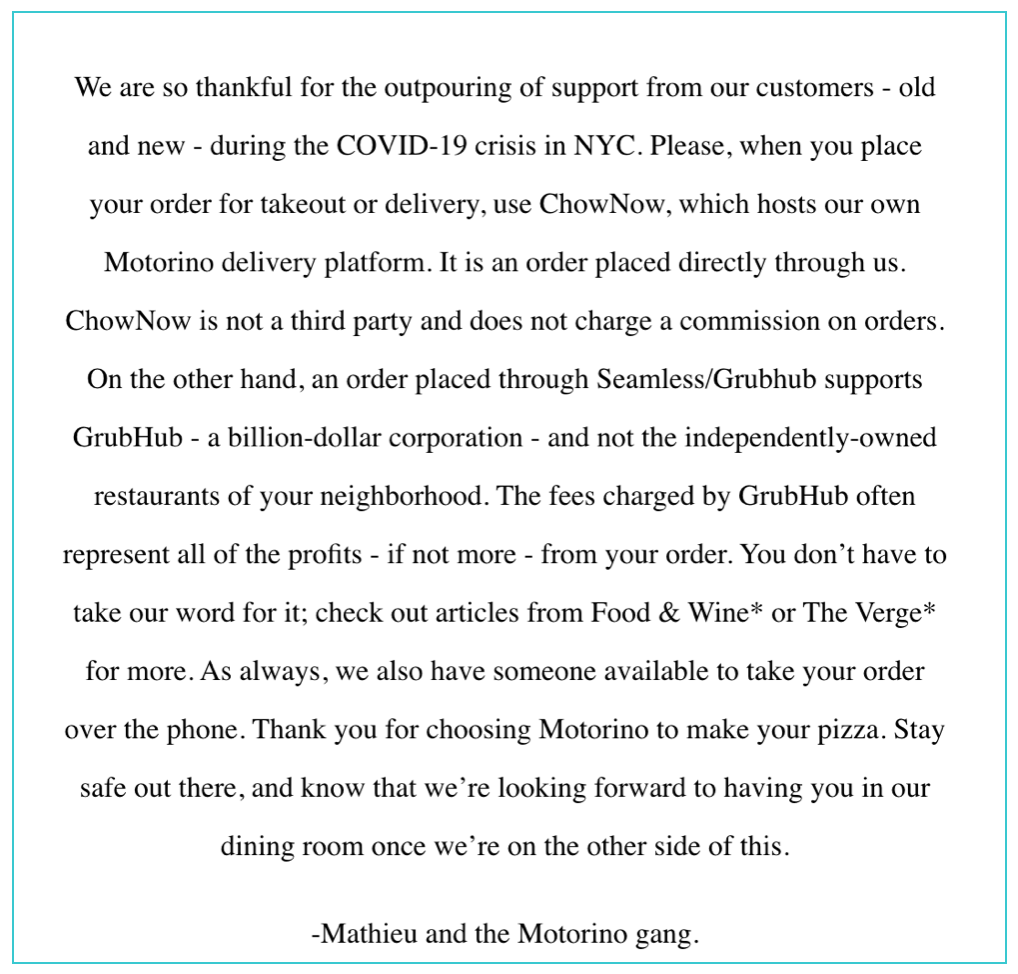

Or if you want to see the argument laid out clearly by a customer, look no further than Motorino Pizza in NYC who posted this note that appears before you enter their website:

A Bigger Truth About Restaurant Food Delivery was originally published in Both Sides of the Table on Medium, where people are continuing the conversation by highlighting and responding to this story.

Originally published on Both Sides of the Table: Original article