In 2023, Iceland’s startup ecosystem underwent a notable transformation following the previous year’s surge in venture capital activity. Despite a global slowdown in venture funding, Iceland saw a decrease in the number of deals compared to the previous five years, with only 21 deals recorded, the lowest in half a decade. However, amidst this decline, the total invested dollars, though more than halved from 2022, remained consistent with 2020 and 2021 levels, indicating a level of stability. This analysis is based on a report by Northstack, a leading tracker of Iceland’s startup scene.

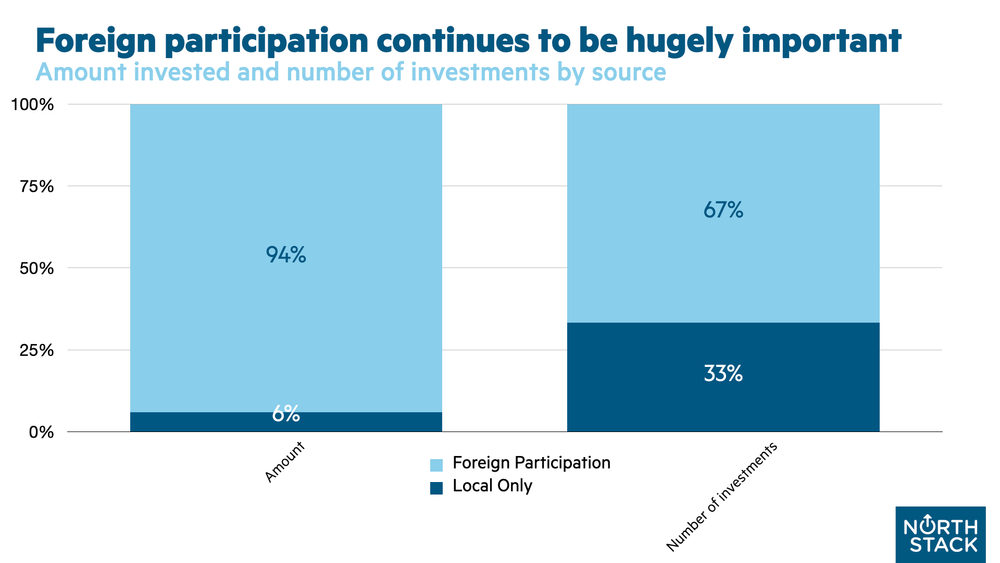

One of the bright spots in Iceland’s startup landscape was the continued strong participation of foreign investors, who contributed to 94% of funding rounds by amount. This underscores the importance of international support in fueling Iceland’s entrepreneurial growth. Additionally, there was a positive trend in gender diversity, with an increased share of funding going to mixed and female-only teams. While the absolute numbers in this category remained modest, primarily in seed or early-stage funding, the shift towards more diverse teams is a promising development.

Despite the challenges posed by the global economic climate, Iceland’s startup ecosystem demonstrated resilience and adaptability. The distribution of funding rounds across different stages of development indicated a healthy mix, with significant activity in both early-stage and larger rounds. This balanced distribution suggests a well-rounded ecosystem that can support startups at various stages of growth.

Looking ahead, Iceland’s startup community remains optimistic, showcasing the country’s enduring spirit of innovation. While the total amount invested in 2023 may not have reached the peaks of 2022, the stability and diversity of Iceland’s startup landscape set a strong foundation for future growth and success.

Click here to read more community news.

Originally published on ArcticStartup : Original article